Credit Repair Myths Debunked: Dividing Reality from Fiction

Wiki Article

A Comprehensive Guide to Just How Credit History Repair Service Can Change Your Credit History

Recognizing the details of credit repair is essential for anyone looking for to enhance their monetary standing - Credit Repair. By attending to issues such as payment history and credit usage, individuals can take positive steps towards boosting their credit rating. Nevertheless, the procedure is often fraught with misunderstandings and prospective challenges that can hinder progression. This guide will brighten the essential approaches and considerations needed for effective credit repair work, inevitably revealing exactly how these initiatives can result in much more positive economic possibilities. What remains to be explored are the particular actions that can establish one on the course to an extra durable credit history profile.Comprehending Credit Ratings

Recognizing credit history is necessary for anyone looking for to enhance their financial health and accessibility far better borrowing alternatives. A debt rating is a numerical depiction of a person's creditworthiness, commonly ranging from 300 to 850. This rating is produced based on the info included in an individual's credit history report, that includes their credit report, arrearages, settlement history, and kinds of charge account.Lenders utilize credit ratings to evaluate the risk related to lending cash or prolonging credit score. Higher scores show lower threat, typically leading to a lot more beneficial car loan terms, such as reduced rate of interest prices and higher credit scores restrictions. Alternatively, reduced credit report can cause higher rate of interest prices or denial of debt altogether.

Numerous variables influence credit rating, consisting of settlement background, which makes up about 35% of ball game, followed by debt utilization (30%), length of credit report (15%), types of credit scores in use (10%), and new credit report queries (10%) Comprehending these aspects can equip individuals to take actionable actions to boost their ratings, inevitably boosting their economic chances and stability. Credit Repair.

Common Credit Scores Issues

Numerous individuals face usual credit rating issues that can prevent their economic progression and impact their credit history. One common problem is late payments, which can considerably harm credit score rankings. Also a single late payment can remain on a credit rating report for several years, impacting future borrowing capacity.

Identity theft is another significant problem, possibly leading to deceitful accounts appearing on one's credit scores report. Addressing these usual debt concerns is necessary to enhancing financial wellness and developing a solid credit history profile.

The Credit Fixing Refine

Although credit score fixing can seem complicated, it is a methodical process that people can embark on to enhance their debt ratings and correct inaccuracies on their credit rating records. The initial step entails acquiring a copy of your credit rating record from the three major credit bureaus: Experian, TransUnion, and Equifax. Testimonial these reports diligently for mistakes or inconsistencies, such as incorrect account information or outdated details.Once errors are recognized, the following action is to challenge these errors. This can be done by speaking to the debt bureaus straight, offering documents that supports your case. The bureaus are needed to examine disputes within 30 days.

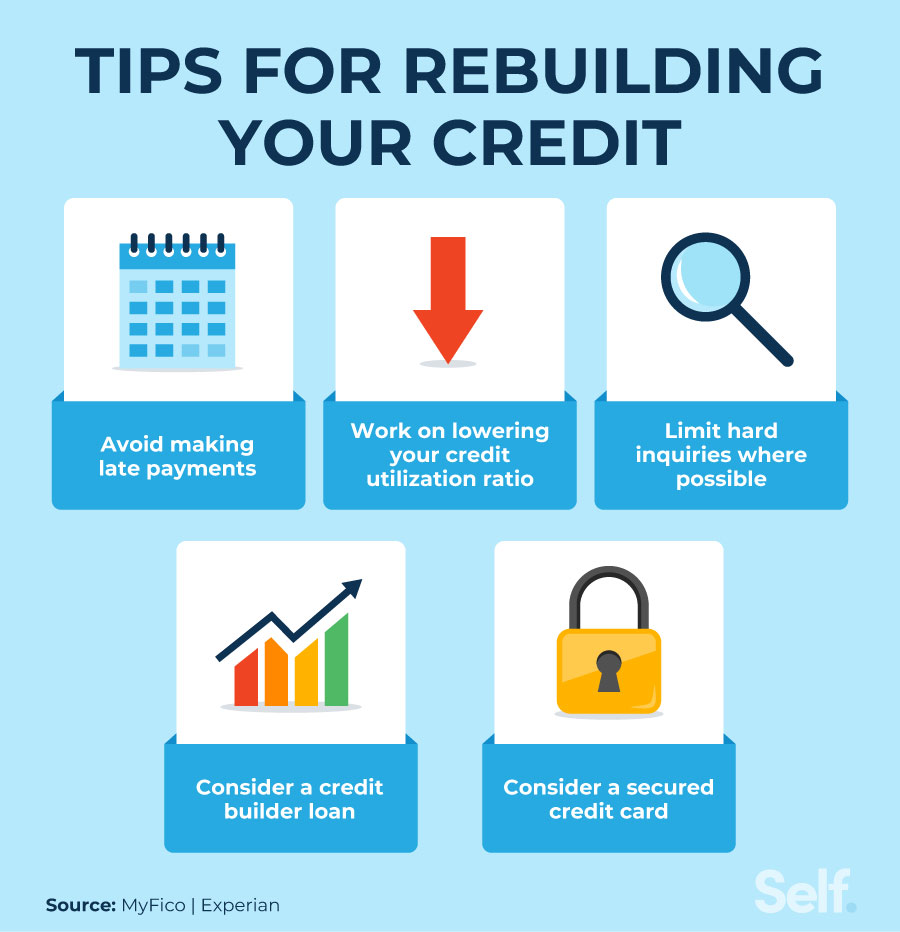

Maintaining a constant repayment background and taking care of credit history use is additionally essential during this process. Checking your credit rating frequently makes sure recurring precision and aids track renovations over time, reinforcing the effectiveness of your credit history repair service efforts. Credit Repair.

Benefits of Credit Scores Repair Work

The advantages of credit repair work prolong far beyond just improving one's credit history; they can considerably affect financial stability and opportunities. By dealing with mistakes and unfavorable products on a credit hop over to these guys rating record, people can improve their credit reliability, making them a lot more attractive to lenders and banks. This enhancement often results in better interest prices on loans, reduced costs for insurance policy, and enhanced possibilities of approval for bank card and home loans.Moreover, credit repair service can facilitate accessibility to essential services that call for a credit report check, such as renting a home or getting an energy solution. With a healthier credit account, individuals may experience increased confidence in their financial decisions, enabling them to make bigger purchases or financial investments that were formerly out of reach.

Along with substantial financial benefits, debt repair work cultivates a sense of empowerment. People take control of their monetary future by proactively managing their credit report, causing even more enlightened selections and better economic proficiency. Overall, the advantages of credit history repair service add to an extra secure economic landscape, inevitably promoting long-lasting financial growth and personal success.

Choosing a Debt Fixing Solution

Picking a debt fixing solution needs careful consideration to ensure that people obtain the assistance they need to improve their economic standing. Begin by looking into prospective business, concentrating on those with favorable consumer evaluations and a tested performance history of success. Openness is crucial; a credible service ought to plainly describe their processes, timelines, and costs ahead of time.Next, validate that the debt repair work service follow the Credit report Repair Service my response Organizations Act (CROA) This federal regulation safeguards customers from misleading techniques and collections guidelines for debt repair work solutions. Prevent firms that make unrealistic guarantees, such as assuring a particular score boost or claiming they can eliminate all negative products from your report.

In addition, consider the degree of customer support offered. A great credit history repair solution should supply personalized help, allowing you to ask concerns and obtain timely updates on your progression. Look for solutions that offer a thorough analysis of your credit report and create a personalized method tailored to your certain circumstance.

Inevitably, selecting the appropriate credit history fixing solution can cause substantial improvements in your credit report, empowering you to take control of your monetary future.

Final Thought

To conclude, reliable credit repair work methods can dramatically boost credit history scores by attending to usual problems such as late repayments and mistakes. A complete understanding of credit elements, incorporated with the engagement of trustworthy credit history repair solutions, promotes the arrangement of unfavorable items and continuous development tracking. Ultimately, the effective renovation of credit report not only brings about far better lending terms but additionally promotes greater financial possibilities and stability, underscoring the relevance of positive credit score administration.By dealing with issues such as settlement history and credit rating utilization, people can take positive steps towards boosting their debt ratings.Lenders utilize credit score ratings to examine article the danger connected with lending cash or prolonging credit score.One more constant issue is high credit report application, defined as the proportion of current credit card balances to complete offered credit.Although credit report repair can seem daunting, it is a methodical procedure that individuals can carry out to boost their credit history ratings and fix inaccuracies on their debt records.Following, validate that the credit scores fixing solution complies with the Credit scores Repair Service Organizations Act (CROA)

Report this wiki page